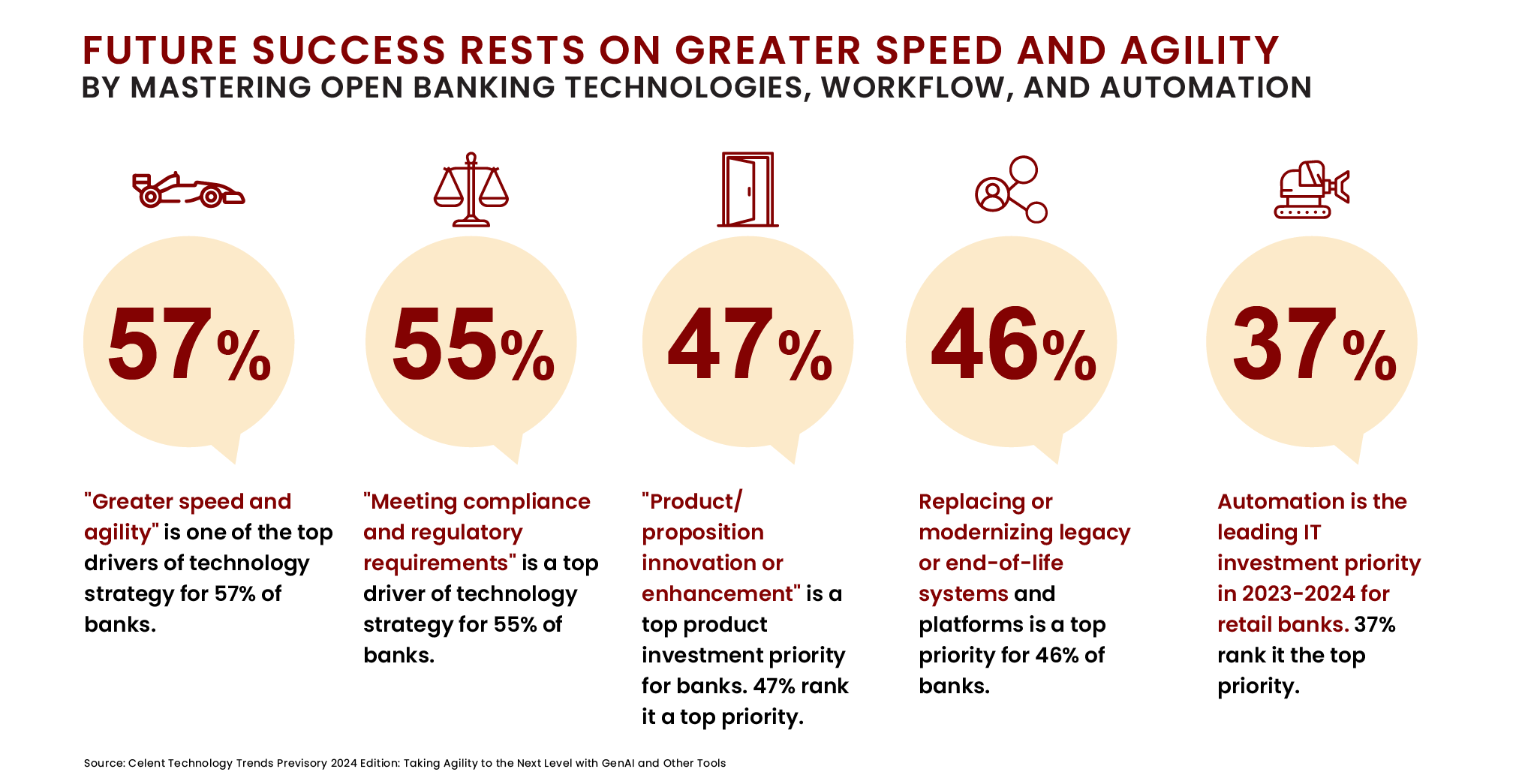

Below are key insights in the evolving landscape of financial services, particularly with the expansion from open banking to open finance and embedded finance:

The Financial Services Ecosystem is driving the need for core banking renewal from Open Banking to Open Finance!

1. Continued Ecosystem Expansion

The financial services sector is indeed becoming more open and interconnected. Open banking initially focused on sharing customer-permissioned data between financial institutions and third-party providers. This facilitated better financial management tools and services for consumers. Now, with open finance, this concept extends beyond data sharing to encompass broader financial products and services, such as loans, deposits, and payments, being offered through non-bank channels.

3. Implications for Institutions

Financial institutions need to adapt by not only complying with regulatory requirements for data sharing (as with open banking) but also by strategically leveraging partnerships and technology to embed their services into various digital ecosystems. This requires robust API frameworks, secure data practices, and a deep understanding of customer needs and behaviors in digital environments.

5. Long-term Outlook

The trend towards openness in financial services is likely to continue, driven by consumer demand for integrated, seamless digital experiences. As technology advances and regulatory frameworks evolve, the ecosystem will likely become even more interconnected, offering both opportunities and challenges for traditional financial institutions, fintechs, and non-bank platforms alike.

2. Embedded Finance

This is a pivotal evolution where financial services are integrated directly into the digital experiences of non-bank platforms. For example, a retail website might offer instant credit options facilitated by a banking partner, seamlessly integrated into the checkout process. This integration enhances convenience and accessibility for consumers, who can access financial services tailored to their needs without leaving the platform they are using.

4. Opportunities and Challenges

There are significant opportunities for financial institutions to expand their reach and customer base through partnerships with non-bank entities. This can lead to innovative product offerings and improved customer experiences. However, challenges such as data security, regulatory compliance, and maintaining competitive differentiation in a crowded marketplace also need careful consideration.

Understanding these dynamics is crucial for navigating the shifting landscape of financial services, where collaboration and innovation are key to staying competitive and meeting consumer expectations in a digital-first world.

It’s clear that the core banking system plays a crucial role in the digital transformation of financial institutions, influencing both back-office operations and front-office customer engagement:

In summary, the core banking system serves as the foundation for digital innovation and operational efficiency in financial services. Its modernization is essential for supporting open banking initiatives and adapting to the demands of a rapidly changing industry landscape.

Our core banking renewal services

Transitioning from legacy banking systems to modern core banking architectures indeed presents both challenges and significant opportunities for financial institutions. These aspects include:

Challenges of Legacy Systems

- Outdated Technology: Legacy systems often use outdated technology stacks that are difficult and costly to maintain and integrate with new technologies.

- Complex Integrations: Over time, legacy systems accumulate complex integrations and customizations, making them rigid and challenging to update or expand.

- High Costs: Maintaining and operating legacy systems can incur high costs due to maintenance, licensing, and support fees, as well as the need for specialized skills to manage them.

Opportunities with Modern Core Banking

- Enhanced Efficiency: Modern core banking systems leverage contemporary technology such as cloud computing, API-first architectures, and microservices. This enables streamlined operations, automated processes, and faster response times to customer needs.

- Innovative Capabilities: Moving to a modern core allows financial institutions to innovate more rapidly. They can deploy new products and features quickly, adapt to market changes faster, and provide personalized customer experiences.

- Scalability: Modern cores are designed to scale efficiently, accommodating growth in customer base, transaction volume, and new service offerings without significant infrastructure investments.

- Improved ROI: While transitioning to a modern core involves upfront investment, the potential return on investment (ROI) is significant. Reduced operational costs, improved efficiency, increased customer satisfaction, and new revenue streams contribute to long-term financial benefits.

Strategic Imperative

- For financial institutions, overcoming the hurdles posed by legacy systems is not just about technological upgrade but also a strategic imperative. It involves aligning IT infrastructure with business goals, enhancing competitiveness, and meeting regulatory requirements effectively.

- oInstitutions can leverage the transition to modern core banking as an opportunity to reevaluate and optimize business processes, enhance data analytics capabilities, and strengthen cybersecurity measures.

Risk Management

- oManaging the transition from legacy to modern systems involves careful risk assessment and mitigation strategies. This includes ensuring data integrity during migration, managing operational risks associated with system downtime, and providing adequate training for staff to adapt to the new technologies.

While the challenges of legacy banking systems are significant, the opportunities presented by transitioning to a modern core banking architecture are compelling. By embracing technological advancement, financial institutions can position themselves for growth, innovation, and enhanced customer satisfaction in an increasingly competitive landscape.

The R88 approach addresses critical aspects of transitioning to a modern core banking architecture while minimizing disruption and ensuring a seamless client experience. Here’s a breakdown of how their solution facilitates this transition:

In essence, R88’s solution for core banking modernization balances the need for innovation with the practicalities of legacy system integration. It supports financial institutions in adopting modern, flexible architectures while safeguarding operational continuity and maintaining a superior client experience throughout the transition and beyond.

let's begin your digital transformation

R88 has been on the cutting edge of technological innovation in fintech serving the banking and financial services industry, through all aspects of retail and commercial banking, including digital channel transformation, payments, core banking software and outsourcing, enterprise distributed software and beyond. Our experts help our clients navigate even the most challenging aspects of selecting and implementing new technology, saving them time, frustration, and financial resources.